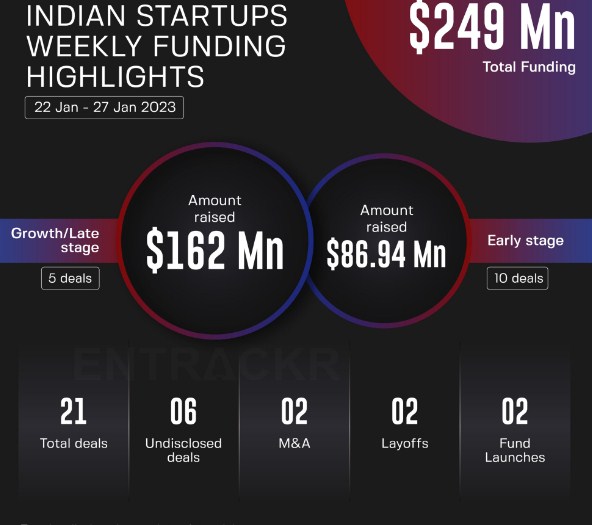

The Indian startup ecosystem witnessed a moderate flow of funding in the third week of January 2024, as 21 startups raised a total of $248.94 million across various sectors and stages. The amount raised by five early-stage startups was undisclosed. The previous week, 28 growth and early stage startups collectively raised $178 million, including three undisclosed deals.

Vivifi leads the growth-stage deals with $75 million fundraise

Among the growth-stage deals, Hyderabad-based non-banking financial company (NBFC) Vivifi was the top performer, as it raised $75 million in its Series B round led by Sequoia India and Falcon Edge Capital. The company, which offers flexible credit products to underbanked customers, plans to use the funds to expand its product portfolio, enhance its technology platform, and grow its customer base.

Another notable growth-stage deal was that of AiDash, a San Francisco and Bengaluru-based enterprise SaaS solution provider, which raised $50 million in its Series B round led by Accel and Emergent Ventures. The company, which uses satellite imagery and artificial intelligence to help utilities manage their infrastructure, aims to use the funds to scale its operations, enter new markets, and hire talent.

Namdev Finvest, a Mumbai-based NBFC that focuses on lending to micro, small and medium enterprises (MSMEs), secured $15 million in its Series A round from LGT Lightstone Aspada. The company, which leverages technology and data to provide customized credit solutions, intends to use the funds to grow its loan book, diversify its product offerings, and strengthen its technology platform.

Two other growth-stage deals were that of Infra.Market and VIKRAN Engineering, which raised $12 million and $10 million, respectively. Infra.Market, a Thane-based construction solutions firm, raised its funds from Tiger Global and Nexus Venture Partners, while VIKRAN Engineering, a Jaipur-based engineering, procurement, and construction company, raised its funds from A91 Partners.

Krutrim tops the early-stage deals with $50 million unicorn round

In the early-stage segment, 10 startups secured $86.94 million in capital. The most prominent deal was that of Krutrim, a Bengaluru-based artificial intelligence startup founded by Ola co-founder Bhavish Aggarwal, which raised $50 million in its Series A round led by Tiger Global and Coatue Management. The company, which is developing a general-purpose AI platform, became the fastest Indian startup to achieve a unicorn valuation of over $1 billion.

Other early-stage deals included Ecofy, a Delhi-NCR-based NBFC that offers credit products to small businesses, which raised $10 million in its seed round from Matrix Partners India and Stellaris Venture Partners; SCOPE, a Bengaluru-based networking platform that connects startups, investors, and industry experts, which raised $8 million in its pre-Series A round from Accel and Lightspeed India; and Newme, a Delhi-NCR-based fast fashion direct-to-consumer brand that targets gen-z customers, which raised $6 million in its seed round from Elevation Capital and Matrix Partners India.

The list also featured RagaAI, a Bengaluru-based AI startup that provides conversational AI solutions for enterprises, which raised $5 million in its seed round from Nexus Venture Partners and Blume Ventures; Convenio, a Bengaluru-based startup that offers a cloud-based platform for managing employee benefits, which raised $4.94 million in its pre-seed round from Sequoia Capital India’s Surge and Y Combinator; and STAN, a Mumbai-based gaming startup that develops hyper-casual games, which raised $3 million in its seed round from Elevation Capital and Matrix Partners India.

Additionally, Bookingjini, DocOsage, Studiovity, The Kenko Life, Kofluence and Analytics Jobs also raised capital but did not disclose the funding amount.

Bengaluru and fintech dominate the city and sector-wise distribution

In terms of city-wise distribution of funding deals, Bengaluru-based startups topped the list with eight deals, followed by Mumbai, Hyderabad and Delhi-NCR-based startups with four, three and three deals, respectively. Moreover, Thane and Jaipur-based startups were next on the list.

In terms of sector-wise distribution of funding deals, fintech emerged as the most preferred sector, with seven deals, followed by SaaS, construction, and gaming, with three deals each. Moreover, AI, HR tech, e-commerce, spacetech, and interior design were also among the sectors that attracted funding.

Series B and seed stage deals share the top spot

This week, Series B and seed stage deals shared the top spot with nine deals each, followed by pre-seed and pre-Series A stage startups with four and two deals, respectively.

Funding trend shows a 39.9% increase from the previous week

On a weekly basis, startup funding went up 39.9% this week to $248.94 million as compared to $178 million in the previous week. The average funding in the last eight weeks stands around $299 million with 23 deals per week.

M&A activity sees two deals in gaming and traveltech sectors

This week witnessed two acquisitions in the gaming and traveltech sectors. Nazara-owned NODWIN Gaming acquired Comic Con India, which hosts multiple pop cultural festivals targeting youth in India. The deal size was not disclosed, but it is estimated to be around $10 million. Traveltech firm MakeMyTrip acquired a majority stake in intercity cab service provider Savaari Car Rentals for an undisclosed amount. The deal will help MakeMyTrip expand its offerings in the ground transportation segment.

Layoffs and shutdowns affect healthtech and foodtech sectors

Health and wellness platform Cult.fit (formerly Cure.fit) has laid off around 150 employees this week as part of its restructuring process. The company said that the layoffs were due to the impact of the Covid-19 pandemic on its business and the need to optimize its costs. Foodtech and quick commerce decacorn Swiggy is laying off 5-6% of its overall workforce as the company is looking to turn profitable by the second half of this year. The layoffs will affect around 800-900 employees across various functions and geographies.

Comments