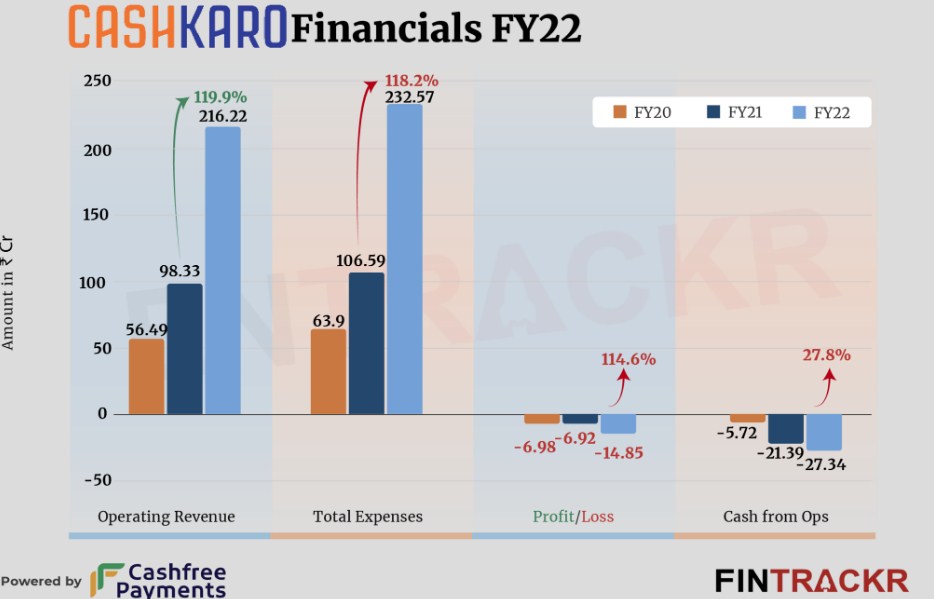

CashKaro, India’s leading cashback and coupons platform, has announced its financial results for the fiscal year ending March 2023. The company, which is backed by veteran industrialist Ratan Tata, recorded a 15.28% increase in its revenue from operations to Rs 249 crore in FY23, up from Rs 216 crore in FY22. The company also managed to reduce its losses by 26.67% to Rs 11 crore in FY23, compared to Rs 15 crore in FY22.

How CashKaro works and what drove its growth

CashKaro operates as a B2C brand that offers its users cashback, rewards, coupons, and deals for online shopping across over 1,500 e-commerce platforms, including Amazon, Flipkart, Myntra, Nykaa, Tata 1mg, and boAt. The company earns commissions from these platforms for driving sales and shares a portion of it with its users as cashback. CashKaro claims to have over 10 million registered users and over 5 million monthly active users on its platform.

The company attributed its revenue growth to the expansion of new categories, such as health, beauty, and wellness, as well as the increase in sales of mobiles and electronics, and the surge in travel bookings. The company also launched several ad campaigns, featuring celebrities like Sonakshi Sinha and Ayushmann Khurrana, to boost its brand awareness and user acquisition. The company said that it recorded a gross merchandise value (GMV) of Rs 4,500 crore in FY23, which is the total value of the products and services purchased by its users through its platform.

How CashKaro reduced its costs and improved its margins

CashKaro’s biggest cost component is the cashback that it offers to its users, which accounted for 52% of its total expenditure in FY23. However, the company was able to marginally reduce this cost to Rs 137 crore in FY23, down from Rs 140 crore in FY22. The company also spent Rs 58 crore on advertising and promotion, which was a 20.8% increase from the previous year. The company’s employee benefits, store service, purchase of e-vouchers, and other overheads took its total expenditure to Rs 263 crore in FY23, which was a 12.88% increase from Rs 233 crore in FY22.

By controlling its costs and increasing its revenue, the company was able to improve its margins and reduce its losses. The company’s EBITDA margin, which is the ratio of earnings before interest, taxes, depreciation, and amortization to revenue, improved to -2.8% in FY23, up from -7% in FY22. The company’s return on capital employed (ROCE), which is the ratio of earnings before interest and taxes to capital employed, improved to -6.4% in FY23, up from -28% in FY22. The company also spent Rs 1.06 to earn a rupee in FY23, which was slightly lower than Rs 1.08 in FY22.

What are CashKaro’s plans and challenges for FY24

CashKaro has set an ambitious target of achieving a 30-40% jump in its revenue to Rs 350-375 crore in FY24. The company plans to leverage its existing user base and partner network, as well as launch new products and features, to drive its growth. The company also plans to expand its presence in tier 2 and tier 3 cities, where it sees a huge potential for online shopping and cashback. The company also aims to become profitable and cash positive in the next fiscal year.

However, CashKaro also faces some challenges and uncertainties in its business model. The company is dependent on the commissions that it receives from its e-commerce partners, which may vary or reduce over time. The company also faces competition from other cashback and coupons platforms, such as CouponDunia, PaisaWapas, and LetyShops, as well as from e-commerce platforms themselves, which may offer their own cashback and rewards programs. The company also has to deal with the changing consumer behavior and preferences, as well as the regulatory and legal environment, that may affect its operations and growth.

Comments